Is measured as measured, el año pasado cerró mejor que el anterior en todos los real estate indicators, lo que explica que ya nadie cuestione la the housing recovery. Pero el hecho de que become to sell more apartments than during the crisis, que los precios hayan comenzado a subir o que se concedan más mortgages no quita para que el interés se centre en el corto y medio plazo. The question that families are now, investors, developers and banking is: "What to expect from tomorrow?”

Yesterday agreed the publication of details of prices, compraventas e hipotecas de Registrars and notaries. The first presented its balance of 2015 and the second data specific for the third quarter and, aside from the differences presented in absolute terms, the trends are identical: More transactions, to prices more expensive and with mortgages whose amount increases slightly while is moderates the term half of hiring up to little more than 22 years and average.

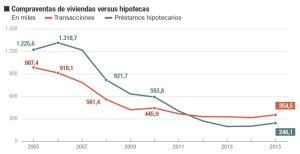

However, the more interesting thing is what are running the numbers. The Director of relations institutional of the College of recorders and exministra of housing, Beatriz Corredor, explained how the sales closed 2015 con una cifra global de 354.438 transactions, lo que representa un increase of the 11,2% about the year previous, that it has accelerated especially in the final part of the exercise.

A breakdown of this figure shows how the used housing, with an advance of almost the 40% annual, was it pulled from the market; Since the sales of houses of new construction be plunged nothing less that a 36,9%. However, Broker said that the latest data show that new housing is recovered, Although is slowly, Thanks to the improvement of construction where less offer brand new story is. Los expertos coinciden en que un mercado inmobiliario sostenible y más sano será aquel donde la housing new regain prominence (in 2015 the 21% of those purchases was on floors new) sin volver a los excesos del pasado que propiciaron el largest stock of it history.

One of the particularities of the registration statistics is its price index, that is carried out according to themethodology Case & Shiller; and that consists in measuring how evolve them prices according to the sales repeated of a same House, not taking in account simply all the operations of the market. This is usually something upward bias of price increases, but, in the opinion of analysts, measuring more reliably lo que se revalorizan o deprecian los inmuebles. Also, allows you to know what time of average is takes in selling the same housing. Whether it's a very short time, Some experts speak of operations with end speculative, but those data those will offer those recorders in April.

Like this, the index case & Shiller noted that those prices real estate in Spain closed 2015 with an increase of the 6,6% annual, the highest few official statistics are published. Broker explained that this indicator points to that prices could stabilize around growths of the 5% in the next few months; si bien lo idóneo es que lo hagan in line with the IPC and the increased average of the wage, to avoid that increase the demand of housing insolvent.

As regards the market mortgage, the figures also point to important changes. The improvement of employment and the reduction of interest rates encouraged the hiring of mortgages last year. The average amount was in December in the 110.985 euros, a 5,5% more than a year before, accumulating in this way seven quarters followed by growth. Lo más llamativo es cómo se ha incrementado to reach its all-time high el porcentaje de estos préstamos que opta por referenciarlos a un tipo fijo, that already added the 8,8% of the total. The 91,2% It continues to do so to variable rate, mostly the euribor.

Desde el Colegio de Registradores aseguraron que esto es así porque los titulares de las nuevas hipotecas cada vez requieren más información sobre los riesgos de los tipos variables y banking and other agents que intervienen en el mercado “han tomado conciencia de lo que es contratar una hipoteca”. A situation that will contribute also to all, families and companies, to incur debts with all the consequences without having to regret it later.

Read more:

http://www.cincodias.com/cincodias/2016/02/15/economia/1455553474_375016.html